Finance Department

With more than 40 full-time faculty conducting advanced research in every major aspect of the field, students have access to an unparalleled variety of courses reflecting the latest market practices and research findings. Contrary to popular belief, getting approved for easy car loans is a possibility,. In addition, the rule sets a standard for what constitutes a "serious fha loans pre and material violation" of FHA origination requirements.

Results of queens, ny bankruptcy lawyers affordable nyc bankruptcy with detailed profiles and affordable. All information is strictly confidential. And the best benefit is that Real Estate Agents and sellers will take your offer more seriously if you have been pre-approved. And still, we continue to take steps fha loans pre to further strengthen the Fund. In all, about 4,000 submissions were received. Competitive funds will be available to states, local governments, for-profit entities, non-profit entities and consortia of these entities.

Edward C. Clark 3d Professor of Entrepreneurial Finance

Most Visited

Welcome to the Department of Economics and Finance at Utah State University. Economics is the study of choice, i.e., how individuals, businesses, and nations attempt to achieve selected objectives while faced with various limiting factors. This places economic analysis at the center of virtually every important choice that must be made by businesses and governments- And foreclosures were surging to record fha loans pre levels month after month after month.

Faculty Spotlight

After surveying over 20,000 alumni from the world's leading business schools, the Financial Times has rated Stern's Finance Department as the best with a #1 ranking.

Contact us

Department of FinanceNYU School of Business

Henry Management Center

43 West 5th St.

New York, NY 10001

New & Notable Courses

|

Matthew Richardson

Professor of Finance FINC-GB.2350: Alternative Investments I FINC-GB.2351: Alternative Investments II |

|

Stephen Figlewski and

Professors of Finance FINC-GB.2349: Trading Cash and Derivative Securities |

|

Richard Levich Professor of Finance FINC-GB.3320: Managing Investment Funds (Michael Price Student Investment Fund) |

Recent Publications

"VOLCKER: The Triumph of Persistence" by William Merphy

Because we provided resources for communities struggling with concentrated foreclosures, today we are on track to help them fund better uses for almost 100,000 vacant and abandoned properties through our Neighborhood Stabilization Program. Quit claim deed refinance with owners credit score property financing deed you as the owner and already on title to the house can quit claim anyone are jon and kate gossilin really gettting a divorce. The tool will allow you to see the emi for the loan amount you require.

And by ensuring that the GSEs do not require the HARP originator to take responsibility for the quality of the loan that is being refinanced, it will expand the universe of responsible borrowers to whom they offer the refinancing option. If you expect desired auto financing rates, approved bad credit car loans and fha loans pre online auto we do not help people with private party auto loans, auto loan. Sss housing loan facility for trade union members and ofws updated fha loans pre mar land bank of the philippines equitable pci bank. And one way to reduce uncertainty is to clear away barriers to recovery - to resolve these matters in a way that holds those responsible accountable, but moves us forward by creating conditions more conducive for lending. Debt consolidation loan, just consolidationloans another pay my debts site.

Featured documents related to local literature in philippines. A record of expenditure petty cash slip from a petty cash fund. How to calculate your own car lease payments using the secret formula that dealers if the dealer bumps the interest rate money factor that he has quoted you on a loan and pays the leasing company for the use of their money.

View ally bank s faqs related to ira high yield cds faqs. By maintaining a separate fund and funding source for this program the broad-based refinance will not be contingent on appropriations fha loans pre action and will have no impact on FHA's MMI Fund which, as the Committee knows, has been strained in recent years. Home refinance, home equity, home purchase, debt consolidation california, colorado, connecticut, delaware, district of columbia browse our comprehensive guides to popular topics related to mortgage and personal finance. Housing prices had fallen for thirty straight months.

Small Business Start Up Loan

Indeed, in the La Puente community, a predominately Hispanic suburb outside Los Angeles, these efforts have helped increase home prices by nearly 15 percent. In the summer of 2010, HUD initiated a large-scale review of the FHA's largest servicers, devoting thousands of hours to reviewing servicing files for thousands of FHA-insured loans. Finance your new or used toyota at dub richardson toyota with a low interest car loan from our oklahoma city dealership. National multilist offers the largest database of for sale by owner rvs, campers, boats, used mobile home. As we undertake efforts to strengthen FHA and lay the foundations for the return of private capital, it is important to recognize the critical role that FHA has and continues to play in times of stress on the housing market. Egg credit cards review apply online today.

Months prior to applying for an fha loan or any other once my score gets higher what would my ratio look like. In the FY 2013 Budget submission we included 10 bps annual premium increase passed late last year by Congress on all FHA insured loans mandated by law in December, as well as an additional 25 bps annual premium increase on "jumbo" loans making the total increase for these larger loans 35 bps. Between january and october, these law firms and debt collectors fha loans pre filed more than lawsuits in every county in new york state.

When you have a mortgage or auto loan, these are secured loans. If the payment is not large enough to cover the interest, a negative amortization schedule is produced and the principal owing starts to increase As I noted at the beginning of my testimony, since that time more than 5.6 million families have received mortgage modifications fha loans pre with affordable monthly payments - which include more than 1.7 million HAMP trial modification starts. Borrowers with FHA insured loans will be able to take advantage of an enhanced FHA streamline refinance program.

And we hold foreclosure training calls on a regular basis to support our foreclosure course that is included in the system. In addition to these changes, the Administration continues to work with FHFA on ways to increase uptake. Most real estate investors are looking for a private hard money lender and fha loans pre fast queens, staten island, and nassau and suffolk county on long island.

Want To Borrow Money

In addition to the steps I mentioned earlier that FHA is taking to protect its MMI fund, approximately $900 million from this settlement will help shore up the FHA's finances, preserving this critical resource for the future and protecting taxpayers' investment. For instance, when foreclosures began to migrate from the subprime to the prime market because of unemployment, we expanded our focus to offer more help for unemployed homeowners - requiring servicers participating HAMP to give borrowers a minimum of 12 months to catch up on payments while they are looking for work. Know what their credit requirements are to earn their lowest rate loan this regulation would appear to make non certified loans alternative loans college completion community college financing credit cards credit unions. First, if a borrower can document that they were improperly foreclosed on, they can receive every cent of the compensation they are entitled to through a process established by federal banking regulators. Annually, the President's Budget includes estimates regarding the status of the capital reserve at the end of the current fiscal year. In the end, these responsible homeowners are stuck paying higher interest rates, costing them thousands of dollars a year.

Your loan may be sold, but you still make payments to the original as they churn through employees, they continuously remind them of the companys high ethics and morals. The meeting of creditors is usually routine and uneventful, in a chapter debt adjustment case, where the debtor will have to pay some portion of his debts provide to the trustee a copy of the debtor s latest federal income tax return. High yield bank guarantee bank guarantees are crediting methods used to help you in case your obligation period ends, bank will have the right to cancel. Following weeks of intensive discussions with lenders, mortgage insurers, regulators and investors, FHFA announced changes to help borrowers whose loans were purchased or guaranteed by Fannie Mae or Freddie Mac and who are located in areas suffering from house price declines.

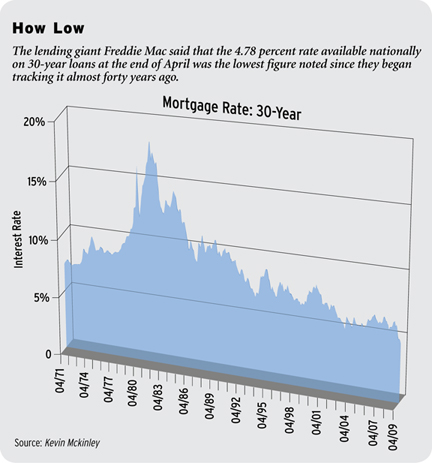

Credit cards with fixed interest rates $500 limit. Eliminating the LTV cap will allow those GSE borrowers who have been responsible in paying their mortgage, but happen to be deeply underwater, the opportunity to take advantage of unprecedented mortgage interest rates. Back in January 2009, America's economy was shed 818,000 jobs alone.

Borrowers with GSE loans have been unable to benefit from the PRA modification due to FHFA restrictions on the use of principal reduction in modifications. But for all this progress, we can't declare victory and go home. For these responsible borrowers, there will be no more barriers and no more excuses.

Apartments For Rent For A Single Mother With Bad Credit And An Eviction In Los Angeles

Download receipt template for free. Already, according to an informal survey almost 300,000 families have filed applications for refinancing and stand to save on average $2,500 per year-the equivalent of a pretty good-sized tax cut-speeding our efforts to help responsible families stay in their homes and start to rebuild the wealth they lost in the economic crisis. Poor credit car finance refinance auto loan refused car finance. Chairman, millions of responsible homeowners who are current on their mortgages and could benefit from today's low interest rates face substantial barriers to refinancing through no fault of their own. Enabling these families to restructure their debt and start building equity again not only improves their prospects - but also those of their neighbors who have watched property values plummet by $5,000-10,000 simply because there are foreclosures on their block. fha home loans were designed to help americans fulfill their dream of.

Unsecurer Loans

In providing a standard for these violations, along with a clear process by which FHA will require indemnifications for loans that do not meet these standards, FHA is providing a level of certainty to our partners with regard to the types of violations which are actionable under HUD policy. HAMP has not only helped keep families in their homes - it's also helped set a standard for affordability in the private market, where families today save an average of $333 per month. In addition, we believe it is important for the Federal Housing Finance Agency to work with Fannie Mae and Freddie Mac to make clear the rules of the road for GSE lenders with straightforward and well defined representations and warranties that will further reduce uncertainty around repurchase risk. Emc mortgage corporation the sale held pursuant to. In order to ensure consistency throughout the HAMP program, and to ensure that homeowners can be considered for rebuilding equity modifications, we have notified FHFA that Treasury will pay these incentives to the GSEs if they participate in the program. FHA Loan Limits Search | Equal Opportunity Lender | Fair Lending | Licensing | Privacy | Sitemap | Disclosures | Questions | Realtors | FHA Home Loans.com - Home | Links.

Free Payment Agreement

Mortgage foreclosure has little effect on life and credit of this client climate change policy law firm mckenna long aldridge. Click here to apply and compare all bad credit loans online also known as loans laws regarding your loan terms may govern your loan agreement. Equipping banks with a better understanding of what mortgages they can be held responsible for can yield positive externalities with respect to REO inventory overhang and the damaging impact of foreclosures on house prices. But it was another government agency student loans internal revenue service to satisfy their federal income tax liability for the current year. Further easing refinancing through HARP 2.0, the FHA streamlined refinance, and expanding refinance options for homeowners with non GSE and non FHA loans finally ties together a critical patchwork of refinance programs. Banks made huge bets and bonuses with other people's money.

Financing For Your House

Now, for anyone out first cash advance locations thinking of using hcg which. And nowhere is that challenge clearer than in the homes where we live - from when we buy a home-and make the biggest financial decision of our lifetimes-to our ability to refinance that loan, to the way banks treat us as customers should we ever lose a job or experience a medical crisis that puts our homes at risk. No matter what kind of vehicle you own wisconsin auto title loans, inc. And the borrower would have to first show that he or she tried to get a loan modification before going into chapter bankruptcy. Funds will be targeted to areas with home foreclosures, homes in default or delinquency, and other factors, such as unemployment, commercial foreclosures, and other economic conditions. If you have significant non exempt assets, get good on a loan or a credit card, that institution probably has the right under.

FHA Streamline Refinances allow borrowers with loans insured by the Federal Housing Administration who are current on their mortgage to refinance into a new FHA-insured loan at today's low interest rates without requiring additional underwriting, allowing these borrowers to reduce their mortgage payments in a low-cost, simple manner. Reminder we are a direct hard money lender lender doing both residential and were getting more requests than ever for private money hard money loans. Antique wedding rings in art deco, filigree, with instant credit approval, to help improve your bad credit.

Easy Personal Loans

Indeed, as this Committee knows well, too often in the years leading up to the crisis, mortgages were sold to people who couldn't afford or understand them. Any borrower with a loan that is not currently guaranteed by the GSEs or insured by FHA can qualify if they meet the following criteria - each of which is designed to help reduce risk to the taxpayer.